Winter Outlook 2025/26

UK Energy Outlook - NESO & National Grid Perspectives

Published 17/10/25

4 minute read time

Welcome to our 2025/26 Winter Outlook blog, where Charles Ramsay, Customer Hedging Manager, looks at the recent forecasts shaping the UK's gas and electricity landscape. As the cold months approach, the National Energy System Operator (NESO) and National Grid have released their Winter Outlooks, offering a unified view of the UK's energy system resilience. These annual reports are essential for stakeholders, delivering insights into supply margins, demand forecasts, and system risks for both gas and electricity. Read on for insights that will help you navigate the season ahead with confidence.

Electricity Outlook: Strong Margins. Low Risk

NESO projects a de-rated margin of 6.1 GW - that's 10% of peak demand, the highest since 2019/2020. This robust buffer between available generation and expected demand signals a healthy system. The Loss of Load Expectation (LOLE), a key reliability metric, is forecast to be well below the 3-hour/yearly standard, meaning minimal risk of supply shortfalls.

Operational Surplus & Tight Periods

NESO anticipates sufficient operational surplus throughout the winter. However, early December and mid-January may see tighter margins due to planned generator outages and peak demand. The system remains well-equipped with tools like the Balancing Mechanism and Capacity Market Notices (CMNs) to manage these periods.

Demand Forecast & Peak Scenarios

Peak electricity demand is expected in December and January, excluding the Christmas period. NESO estimates a 5% chance of demand exceeding 48 GW on at least one day. Even under stress scenarios, such as a 4 GW reduction in supply, LOLE remains within acceptable limits.

Interconnectors & European Imports

Interconnectors continue to play a vital role:

- Assumed rate of 6.9 GW of capacity secured via the Capacity Market

- Minimal planned outages, ensuring high availability

- Great Britain is expected to be a net importer, particularly from France, due to favourable price differentials

National Gas Outlook: Secure Supplies. Smart Demand Management

National Gas expects secure gas supplies for Winter 2025/26. Storage is flexible, and infrastructure investments have strengthened the network's ability to handle peak demand.

Supply & Demand Forecasts: The Numbers

- Total National Transmission System (NTS) demand (including exports): 44.8 bcm (down from 4% last winter)

- UK Continental Shelf (UKCS): 14.5 bcm (6% decrease)

- Norway: 16.0 bcm (stable)

- Liquified Natural Gas (LNG): 10.5 bcm (7% increase)

- Imports from continental Europe: 0.6 bcm

- Storage withdrawals: 2.7 bcm (23% decrease)

LNG is set to play a key role in meeting peak demand, with expansion projects at South Hook and Isle of Grain increasing technical capacity. Isle of Grains Capacity 2025 project has been successfully implemented, bringing a new m³ storage tank, additional systems, and infrastructure upgrades. The facility also now supports over 100 berthing slots, including those for Q-Max tankers, and offers small-scale LNG services.

South Hook's expansion status is currently on schedule and looking at completion for the end of 2025. This will include additional regasification capacity and integration with Golden Pass LNG, whilst also increasing reliability through new vaporisers and piping. UKCS and Norway should provide steady baseload supply throughout the winter period, in harmony with this boost to LNG infrastructure.

Peak Demand Scenarios

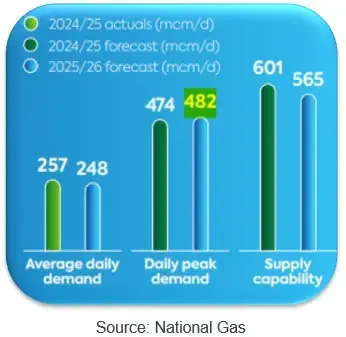

The 1-in-20 peak demand forecast for Winter 2025/26 is 482 mcm/d, a 2% increase from last year. This includes a 12% rise in gas demand for power generation on peak days, as a result of days where renewables are low. Non-daily metered (NDM) demand is projected to decline, reflecting ongoing progress in energy efficiency initiatives. In contrast, other sectors are anticipated to experience modest growth. Gas usage in power generation is particularly noteworthy as it tends to fluctuate in response to immediate requirements, even though overall power demand is expected to decrease over the period. In Ireland, demand is set to rise, primarily driven by increased consumption within the power generation sector.

In cold winter scenarios, GB may also need imports from continental Europe. Peak supply capability is 565 mcm/day, which has fallen year-on-year, predominantly due to a reduction in UKCS and Norwegian flows, lower EU imports and storages with Rough not in use. This has reduced 1-in-20 margin from 127 mcm/day 2024.25, to 83 mcm/day for 2025/26.

Collaboration & Resilience

Electricity and gas operators are working together to balance supply and demand, especially during extreme weather or system stress. Renewable integration continues to help both sectors cut emissions and boost energy security.

National Gas has stress-tested scenarios including high demand and infrastructure loss. The system maintains a positive supply margin under both intact and N-1 conditions. Tools like the On The Day Commodity Market (OCM) and Network Gas Supply Emergency (NGSE) protocols are ready to manage imbalances.

Price Watch

- Electricity: GB wholesale prices are aligned with European markets, with a slight premium over France. Long-term auction results suggest a continued import bias. In terms of base-peak spread this winter, the market is still seeing lots of premium in the winter peak hours which could be indicative of a potential for tightness, however this remains to be seen.

- Gas: Prices have stabilised, despite some volatility. EU storage levels are healthy at 82% as of September 2025, slightly below average, but on track for winter targets. Fundamentals are currently doing well, as Norwegian flows recover from maintenance. Risks remain this winter, primarily of a geopolitical nature, which could continue to lend support to the price environment. In addition, if the winter period proves to be particularly cold, this could lead to increased demand and in turn drive price sentiment, however this remains to be seen.

Final thoughts...

As the energy transition accelerates, these outlooks highlight the importance of ongoing innovation and cooperation to meet future demand reliably and sustainably. The Winter Outlook 2025/26 provides a positive assessment, highlighting that, despite evolving challenges such as increased peak demand, fluctuating renewables, and changes in supply sources, the sector is positively adapting. Enhanced modelling has enabled more accurate forecasting and scenario planning, while strategic coordination between NESO, National Gas, and other operators has reinforced system resilience. The implementation of robust tools, like the On The Day Commodity Market and emergency protocols - further strengthens the system's ability to manage potential imbalances or shocks. With healthy margins, coordinated response plans, and a clear focus on integrating renewables and maintaining supply security, the industry stands well-prepared to overcome the uncertainties of the coming winter and continues progressing towards its net zero ambitions.

For further information on any of the topics covered in this blog, or to talk to our Energy Management team about your energy market needs, get in touch today. We've a team of experts ready to help.

Please visit our BLOG pages to catch up with all our latest content and follow us on LinkedIn for regular updates!